Banking or banking activity that complies with sharia (Islamic regulation) — often known as Islamic banking and finance, or sharia 1 compliant finance 2 — has its own products, providers and contracts that differ from conventional banking. Therefore, specific types of funding in actual estate , either directly or in securitized style (a diversified real property fund), may provide regular retirement earnings whereas not operating afoul of Sharia legislation. There are firm legal guidelines governing the sorts of enterprise the banks can trade with.

Banking or banking activity that complies with sharia (Islamic regulation) — often known as Islamic banking and finance, or sharia 1 compliant finance 2 — has its own products, providers and contracts that differ from conventional banking. Therefore, specific types of funding in actual estate , either directly or in securitized style (a diversified real property fund), may provide regular retirement earnings whereas not operating afoul of Sharia legislation. There are firm legal guidelines governing the sorts of enterprise the banks can trade with.

This is in distinction to standard banking the place the asset’s significance lies solely by way of collateral security but the asset just isn’t necessarily a part of the loan transaction. In response to the Islamic Microfinance Network website (as of circa 2013), 257 258 there are more than 300 Islamic microfinance institutions in 32 nations.

Additionally, in July 2015, the World Financial institution and the Normal Council for Islamic Banks and Monetary Establishments (CIBAFI) , the global umbrella of Islamic financial establishments, signed a Memorandum of Understanding (MoU) to help foster the development of Islamic finance globally and broaden its use as an efficient instrument for financing development worldwide, including in non-Muslim nations.

“Innovative Islamic Hedging Products: Utility of Wa’d in Malaysian Banks”. The sustainable growth of Islamic finance provides benefits for economic progress, lowering poverty and fostering shared prosperity. This means many Muslims in Britain discover themselves in a tough state of affairs, trying to stability the core ideas of Islamic equality with the realities of the British mortgage market.

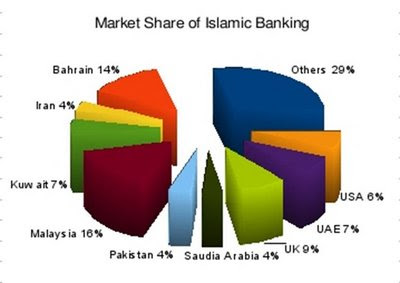

Mortgages from British financial institutions are interest-based mostly, something which doesn’t adjust to Islamic Sharia law. Islamic finance has grown quickly, even though it’s still a small share of the global financial market. There has additionally been a surge of curiosity in Islamic finance from non-Muslim countries such because the UK, Luxembourg, South Africa, and Hong Kong.