How To Get A Small Business Loan In 5 Steps

Businesses want ample amount of funding to fund expenditures associated to enlargement resembling adding new traces to their present products/services. That is probably not an issue in the event you’re in the market for an extended-term enterprise mortgage to finance a major funding. American Categorical® Business Loans will help you flip your corporation goals into actuality. Aside from starting a brand new business, these grants will assist you to broaden your online business, buy required equipment, gear, furniture, inventories and other provides.

Businesses want ample amount of funding to fund expenditures associated to enlargement resembling adding new traces to their present products/services. That is probably not an issue in the event you’re in the market for an extended-term enterprise mortgage to finance a major funding. American Categorical® Business Loans will help you flip your corporation goals into actuality. Aside from starting a brand new business, these grants will assist you to broaden your online business, buy required equipment, gear, furniture, inventories and other provides.

BankSA – A Division of Westpac Banking Corporation ABN 33 007 457 141 Australian credit score licence and AFSL 233714. Please be advised that you’ll now not be topic to, or beneath the protection of, the privacy and safety insurance policies of ESL Federal Credit Union. As a longtime enterprise with growing income, an SBA mortgage is a good choice if you need low charges.

You need not visit our department; we offer door-to-door service for our business loan clients. If you happen to miss multiple repayments, your credit rating will be broken and also you might have authorized proceedings brought in opposition to you or a charging order registered in opposition to your home.

Purchase or refinance enterprise property or increase or rework an present facility. A singular facility helps you withdraw solely what you need and repay funds as per your enterprise cash move at nil-prepayment prices. This could convey your rate of interest to a maximum of 5.5%. For loans due in additional than seven … Read More

A loan funded by participating lending institutions and backed by the Small Business Administration. These days, banks are giving enticing schemes to ladies entrepreneurs These unique enterprise loans for women present them relief when it comes to rates of interest, acceptable loan amounts and applicable collateral. Our flexible tenures on loans make reimbursement easy; you possibly can select your mortgage tenure for any interval between 1 and 5 years.

A loan funded by participating lending institutions and backed by the Small Business Administration. These days, banks are giving enticing schemes to ladies entrepreneurs These unique enterprise loans for women present them relief when it comes to rates of interest, acceptable loan amounts and applicable collateral. Our flexible tenures on loans make reimbursement easy; you possibly can select your mortgage tenure for any interval between 1 and 5 years. Keep your documents organized and deal with meeting lender necessities that can assist you qualify for a loan. Small businesses have a more durable time getting accredited due to components together with decrease gross sales volume and money reserves; add to that dangerous private credit score or no collateral (similar to real property to safe a mortgage), and lots of small-business owners come up empty-handed.

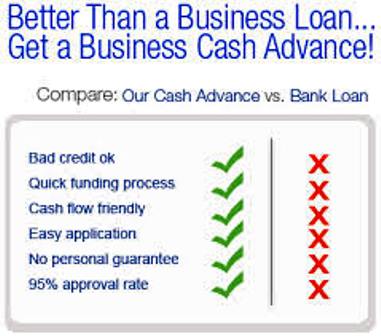

Keep your documents organized and deal with meeting lender necessities that can assist you qualify for a loan. Small businesses have a more durable time getting accredited due to components together with decrease gross sales volume and money reserves; add to that dangerous private credit score or no collateral (similar to real property to safe a mortgage), and lots of small-business owners come up empty-handed.