M&t Financial Institution Company Accounting Enterprise Techniques Analyst I Job In Buffalo, Ny

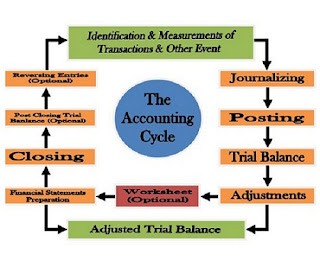

This method, whenever you obtain a fee or make a business expense, a journal entry is routinely generated. When in search of free accounting software program, you’ll want to contemplate features that are essential for small businesses, similar to invoicing, time monitoring and expense tracking. You’ll additionally wish to discover software that is simple to use and obtainable on multiple platforms. If you’re a Linux person, your selections for free accounting software program are more limited. GnuCash is a good possibility that’s compatible with Linux, as well as Windows, BSD, Solaris and Mac. It includes options, corresponding to bank account monitoring, expense monitoring, financial calculations and stories. While it doesn’t have as many extras with its small business features, it makes up for it in flexibility, with the flexibility to trace stocks, commodities and different investments.

The core banking system additionally has a lending management program built-in, serving alternate monetary services corporations and banks and credit score unions. According to differentestimations, 10 main financial software program firms management virtually 50% of the market. The record contains Microsoft, FIS, Fiserv, SAP, Oracle, Temenos, SAS, and others. But we also can have a look at the list of top 10 banking software program options, and precise products. They function completely different functions, from core banking to digital-only presents. You can explore these methods to search out out in the event that they suit your needs.

myBillBook is smartphone accounting software program for small and medium companies. Available at a very nominal price, … Read More