Payday Mortgage

There is not any credit inquiry here so that each shopper can cowl their money gaps and receive fast funding. You don’t have to rack your brains over the subsequent financial emergency that hit you abruptly. If you should borrow cash instantly, you have a chance to solve any small problem linked with private loans even when you are pressed for money and there are still a few weeks left till the following wage day. Don’t be afraid of credit score checks because the providers of a cash borrowing app often conduct a gentle credit score examine.

If you’ve a positive balance, there is nothing to fret about. Make certain you utilize on-line apps properly and take full accountability for the aid transferred to your debit card.

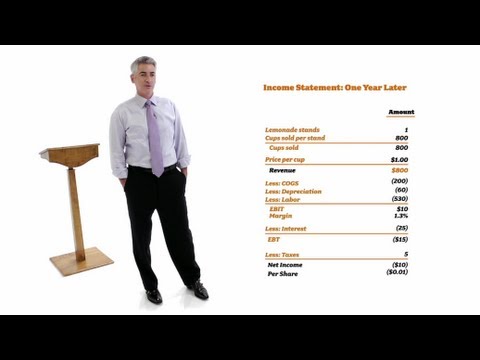

Whatever unexpected expense happens, you will have to pay the debt off on time. If you’ve an active checking account, you might need to understand how much it is possible to withdraw with this app. Usually, money advance apps that loan cash present an opportunity to obtain a decent quantity of additional funds. Using the PayDaySay app, you could get from $100 to $5,000 on your immediate cash wants. Compare payday loans in Columbus, Ohio with Instacash and Credit Builder Loans, then resolve which is best for you.

For some causes you might need received a unfavorable credit ratings score which averts you from borrowing cash from the financial institutes. No credit score verify loans avert this by making use of your current … Read More